how to calculate nh property tax

So if your home is worth 200000 and your property tax rate is 4 youll pay about 8000 in taxes. Multiply the rate by 1000 and you get the property tax rate per 1000 of property value which is how the rate is usually stated.

Historical New Hampshire Tax Policy Information Ballotpedia

Enter as a whole number without spaces dollar sign or comma.

. For example if. The tax rate is set in October by the DRA. Heres how to find that number.

The median property tax on a 24970000 house is 262185 in the United States. For a more specific estimate find the calculator for your county. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Enter your Assessed Property Value Calculate Tax 2021 Taxes The property tax calculated does not include any exemptions elderly veterans etc that you may be entitled to. The State of NH imposes a transfer fee on both the buyer and the seller of real estate at the rate of 750 per 1000 of the total price. Property tax is calculated based on your home value and the property tax rate.

Your household income location filing status and number of personal exemptions. As well explain later appraising real estate billing and collecting payments performing compliance tasks and working out conflicts are all reserved for the county. Normally once per three years or more often a county assessor re-examines and determines whether to revise propertys estimated worth.

This means the buyer will need to reimburse the seller for taxes covering January 31st to March 31st. Tax rates are expressed in mills with one mill equal to 1 of tax for every 1000 in assessed property value. The annual appreciation is an optional field where you can enter 0 if you do not wish to include it in the NH property tax calculator.

At that rate the property taxes on a home worth 200000 would be 4840 annually. This estimator is based on median property tax values in all of New Hampshires counties which can vary widely. New Hampshire Property Tax Calculator.

Real property evaluations are. The state and a number of local government authorities determine the tax rates in New Hampshire. The result is the tax bill for the year.

For transactions of 4000 or less the minimum tax of 40 is imposed buyer and seller are each responsible for 20. By law the property tax bill must show the assessed value of the property along with the tax rates for each component of the tax. The median property tax on a 24970000 house is 464442 in New Hampshire.

Towns school districts and counties all set their own rates based on budgetary needs. Figuring Taxes New Hampshires tax year runs from April 1 through March 31. If a closing takes place on April 30th the tax bill covering that period will not be paid until July 1st.

Although the Department makes every effort to ensure the accuracy of data and information. State Education Property Tax Warrant. Data and information contained within spreadsheets posted to the internet by the Department of Revenue Administration Department is intended for informational purposes only.

Online Property Tax Calculator Enter your Assessed Property Value in dollars - Example. However local authorities are at liberty to set their own tax rates depending on their budgetary requirements. The 2020 real estate tax rate for the town of stratham nh is 1895 per 1000 of your propertys assessed value.

Current tax rate 01598 X your assessment your taxes for the year. Here is a break down of what the 1598 tax rate goes to. New Hampshire Real Estate Transfer Tax Calculator.

If a closing takes place on January 31st the seller would have already paid the December bill which covers through March 31st. Divide the total transfer tax by two. The tax rate for 2021 is 1598 per thousand of your assessment.

Total Estimated Tax Burden. Municipal local education state education county and village district if any. This calculator is based upon the State of New Hampshires Department.

To calculate the daily interest charge you owe the state multiply the tax bill with 012 then divide by 365 for days in a single year. To estimate your real estate taxes you merely multiply your homes assessed value by the levy. 300000 x 015 4500 transfer tax total 2.

Use the tax calculator below to figure out what your taxes could look like or use this simple formula. While observing legal limitations prescribed by statute Rochester sets tax rates. In new hampshire the real estate tax levied on a property is calculated by multiplying the assessed value of the property by the real estate tax rate of its location.

The New Hampshire property tax rate is higher than the national average. Income Tax. Take the purchase price of the property and multiply by 15.

Percent of income to taxes. A reassessed value is then multiplied times a total rate from all taxing entities together to calculate tax billings. To calculate the annual tax bill on real estate when the property owner isnt eligible for any exemptions multiply the assessed value by the total tax rate and divide the result by 1000.

New Hampshire Property Tax Calculator to calculate the property tax for your home or investment asset. In NH transfer tax is split in half by buyer and seller. In new hampshire the real estate tax levied on a property is calculated by multiplying the assessed value of the property by the real estate tax rate of its location.

Timber Basis Decision Model A Calculator To Aid In Federal Timber Tax Related Decisions Extension

2021 Tax Rate Set Hopkinton Nh

Residential Taxpayer Resources Nashua Nh

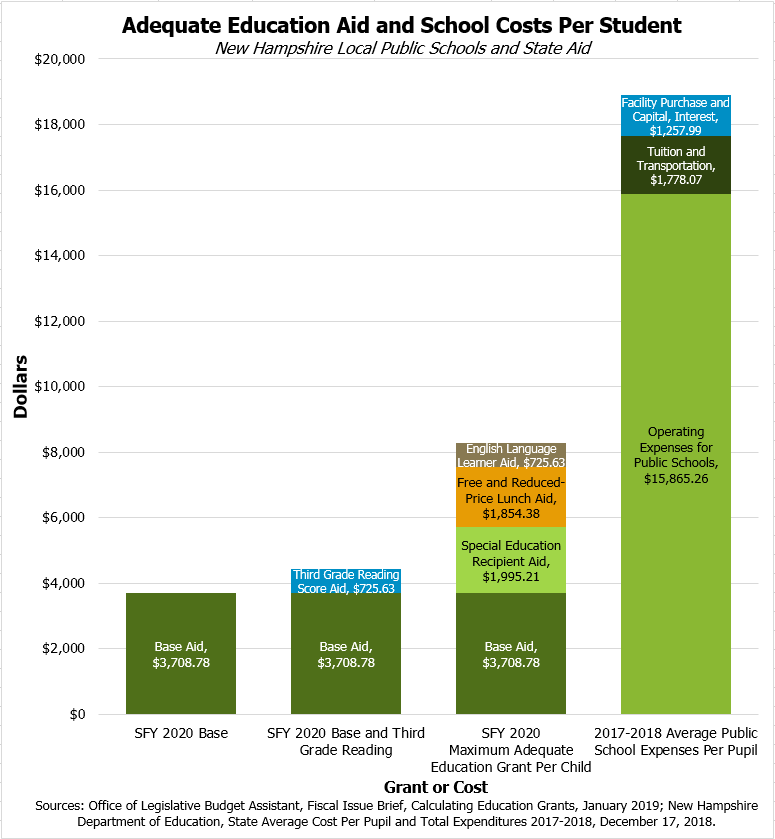

Education Funding In The House Budget New Hampshire Fiscal Policy Institute

What You Should Know About Moving To Nh From Ma

New Hampshire Property Tax Calculator Smartasset

Online Property Tax Calculator City Of Portsmouth

Budget Replaces Targeted Aid With Tax Cut Disproportionately Benefitting Owners Of Higher Valued Properties Reachinghighernh

Statewide Education Property Tax Change Provides Less Targeted Relief New Hampshire Fiscal Policy Institute

City Launches Online Property Tax Calculator To Help Estimate New Tax Bill Manchester Ink Link

New Hampshire Property Tax Calculator Smartasset

Florida Property Tax H R Block

How To Calculate Transfer Tax In Nh

How We Fund Public Services In New Hampshire New Hampshire Municipal Association

State Education Property Tax Locally Raised Locally Kept

My Property Taxes Are What Understanding New Hampshire S Property Tax Milestone Financial Planning

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)